The Truth About Down Payments

September 3, 2025

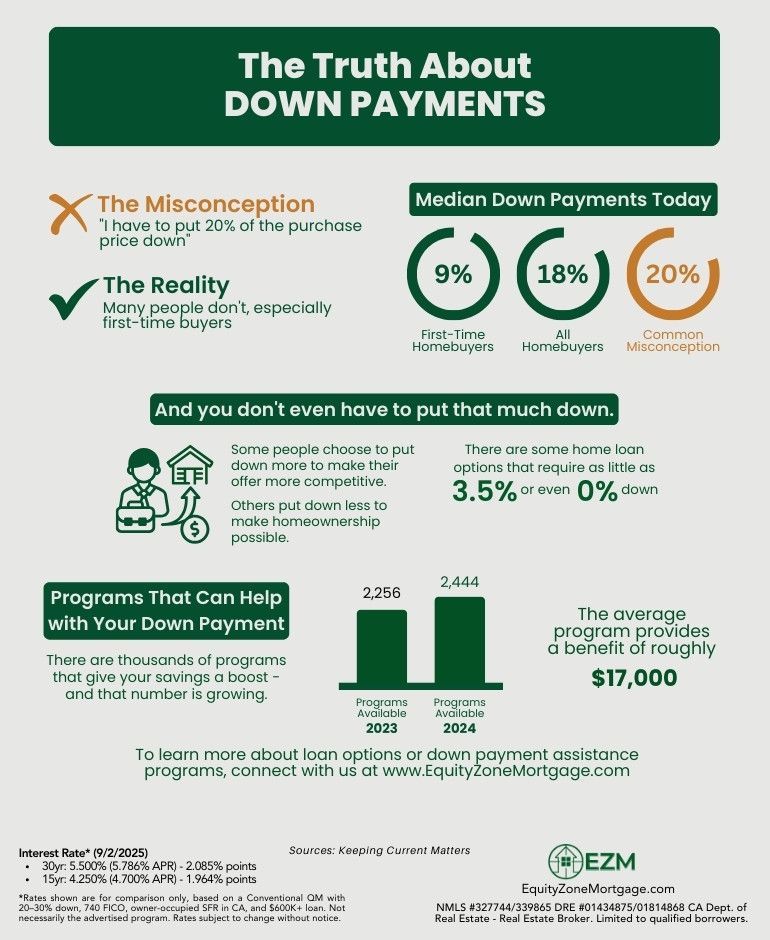

The Truth About Down Payments

As a mortgage professional, it's essential to understand the facts about down payments. Here are three key points to consider:

- Down Payments are Not Always Necessary While a down payment is typically required to secure a mortgage, there are alternative options available. Some mortgage programs, such as FHA loans, allow for down payments as low as 3.5%. Additionally, some lenders offer mortgage options with no down payment required for qualified borrowers.

- The 20% Rule is a Myth The traditional rule of thumb is that you need to put 20% down to avoid private mortgage insurance (PMI). However, this is not always the case. PMI can be avoided with lower down payments, and some lenders offer mortgage options with lower PMI rates.

- Down Payments Can Be Gifted In some cases, down payments can be gifted from family members or other approved sources. This can be a helpful option for first-time homebuyers or those with limited savings. However, it's essential to understand the rules and regulations surrounding gifted down payments to avoid any potential issues.

For more information on down payments and mortgage options, please don't hesitate to contact me. I'm here to help you navigate the mortgage process and find the best solution for your needs.

Learn More:

https://www.equityzonemortgage.com

Maximize Your Home Buying Power!

READ MORE POSTS

Grow Your Real Estate Portfolio — No Income Docs Needed! U nlock financing with our Non-QM No Ratio Mortgage Loan Program — perfect for investors who want flexibility, speed, and opportunity. ✅ No Income or DTI Verification Qualify based on your assets, credit, and down payment — not your tax returns or income ratio. ✅ Perfect for Experienced Investors Ideal for those with multiple rental properties or strong equity positions looking to expand their portfolio. ✅ Flexible Loan Options Enjoy competitive terms, fast approvals, and no limit on the number of financed properties. Ready to expand your investment portfolio? Let’s make your next property purchase simple and stress-free. Contact me today to learn how our No Ratio program can help you close more deals! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Are You Ready to Buy Your Vacation House? Your dream getaway could be closer than you think! 3 Reasons to Start Today: ✅ Use It, Rent It, Profit From It! – Enjoy your vacation home when you want and rent it out when you don’t. ✅ Lock in Today’s Rates – Secure a low rate before prices climb higher. ✅ Flexible Loan Options – We have programs designed for second homes and investment properties alike. Let’s make your vacation home dream a reality! Contact us today to get started. Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Mortgage Pre-Approval: What You Need & Why It’s So Important What You’ll Need for Pre-Approval To get pre-approved, lenders typically ask for: ✅ Proof of Income – Recent pay stubs, W-2s, or tax returns (if self-employed). ✅ Proof of Assets – Bank statements, investment accounts, or savings for down payment and closing costs. ✅ Credit Information – Authorization to pull your credit report. ✅ Employment Verification – Employer contact or employment letter. ✅ Identification – Government-issued ID (driver’s license, passport, etc.). Why Pre-Approval Is So Important Know Your Budget – Helps you understand how much home you can afford before shopping. Stronger Offer – Sellers take you seriously since you’re already vetted by a lender. Faster Closing – Most of the paperwork is already done, so you can move quickly when you find your dream home. Spot Potential Issues Early – Identify and fix credit or income documentation issues before it’s too late. Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Turn Your Online Income Into a New Home! You’ve built your business online — now let your profits help you buy your dream home with a flexible Non-QM P&L + CPA Letter Loan! ✅ No Tax Returns Needed – Qualify using your Profit & Loss Statement and a CPA Letter — perfect for e-commerce or online entrepreneurs. ✅ Flexible Income Verification – We understand online sales fluctuate — we look at your real business performance, not just your tax write-offs. ✅ Faster, Hassle-Free Approval – Simplified documentation and quick review designed for Amazon, Shopify, Etsy, or Social Media Sellers. Your online hustle deserves a home! Let’s turn your business success into homeownership today. Contact us now to get started! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Are You Ready to Buy Your New Home? Your dream home is closer than you think! Here’s why now is the perfect time to start: 1️⃣ Low Down Payment Options — Get into your home with less cash upfront. 2️⃣ Flexible Loan Programs — We have solutions for first-time buyers, self-employed clients, and more! 3️⃣ Expert Guidance Every Step — From pre-approval to closing, we make homebuying simple and stress-free. Don’t wait — your new home is waiting for you! Contact us today to get started on your homeownership journey. Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Benefits of Homeownership 👉 Turn Your Rent Into Equity Every month you’re paying rent, you’re helping someone else build wealth. Why not invest in yourself instead? Owning a home means building equity, gaining financial stability, and creating a space that’s truly yours. It might seem out of reach, but with the right guidance, it’s more possible than you think. 👉 Build More Than a Home—Build a Future Homeownership isn’t just about having your name on a deed. It’s about planting roots, building long-term wealth, and gaining the freedom to shape your space your way. Whether you're buying your first home or just exploring options, I’m here to make the process simple, clear, and empowering. 👉 You Deserve More Than a Lease Renting may feel easy—but owning gives you control, stability, and a future you can count on. No more rent hikes, no more landlord rules—just a home that’s truly yours and a payment that builds your wealth. Let’s explore your options and see what’s possible—you might be closer than you think! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

INVEST IN SHORT-TERM RENTALS WITH EASE DSCR Business Purpose Loans – No NMLS License Needed in Many States! Unlock Property Potential Without Traditional Lending Headaches Designed for savvy investors and Airbnb hosts, our Non-QM DSCR (Debt-Service Coverage Ratio) mortgage program is perfect for growing your short-term rental portfolio – no tax returns or income docs required! Why STR / Airbnb Hosts Love This Loan: ✅ No Personal Income Required We qualify based on property cash flow – not your job or W-2. ✅ Close in an LLC or Business Name Ideal for investors looking to separate personal and business assets. ✅ No NMLS License Required in Many States Grow your business with fewer restrictions – ask us how. Ready to Expand Your STR Empire? Call now or schedule a free consultation today! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Did you know your home’s equity could help you build an ADU? Whether you're looking to boost your property value or create a cozy rental space, your home’s equity might be the perfect solution! Check out these three reasons why now is the time to tap into your equity: 1️⃣ Build Extra Income Turn your unused space into a rental unit! An ADU can provide steady monthly income, helping you pay down your mortgage or fund your dreams. 2️⃣ Increase Property Value An ADU doesn’t just create more space—it boosts your home’s overall market value. A smart investment today can pay off tomorrow. 3️⃣ Flexible Living Solutions Need space for family? Want a home office? An ADU can offer endless possibilities, from a guest suite to a home gym or studio. Unlock your home’s potential. As a trusted mortgage professional, I can help you explore financing options to make your ADU dreams a reality. DM me to learn more or schedule a consultation! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Why Homeowners Feel Thankful for Their Homes This Season Gratitude runs deeper when you own your space. As we enter a season of thanks, more homeowners are realizing just how much their homes truly give back — in comfort, value, and opportunity. Here’s why homeowners are feeling extra thankful: 💰 1. Home Equity Growth Homeowners are sitting on thousands (sometimes hundreds of thousands) in equity — and it’s growing! That means more financial freedom for upgrades, education, or consolidating high-interest debt. 🔒 2. Stability in an Uncertain World While rents rise and markets shift, having a fixed mortgage and a place to truly call your own provides unmatched peace of mind. ✨ 3. A Place to Build Your Life It’s not just a house — it’s where memories are made, kids grow up, and milestones happen. That sense of pride? You earned it. Feeling thankful... but not yet a homeowner? Or curious how your home equity could work for you? Let’s talk options — I’m here to help. DM me for a free home equity review or to explore homeownership. Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!

Home Loans Designed for the Self-Employed Qualify with Bank Statements – Not Tax Returns Why Entrepreneurs Love Our Bank Statement Mortgage Program: ✅ No Tax Returns Required We use 12 to 24 months of personal or business bank statements to qualify—perfect for self-employed borrowers with complex income. ✅ Flexible Credit Guidelines Credit challenges? No problem. We work with a wide range of credit scores to help more business owners become homeowners. ✅ Loan Amounts Up to $3 Million Whether you're buying, refinancing, or cashing out—our program supports high-value financing for growing businesses. Ready to turn your business success into homeownership? Call us today! Learn More: https://www.equityzonemortgage.com Maximize Your Home Buying Power!