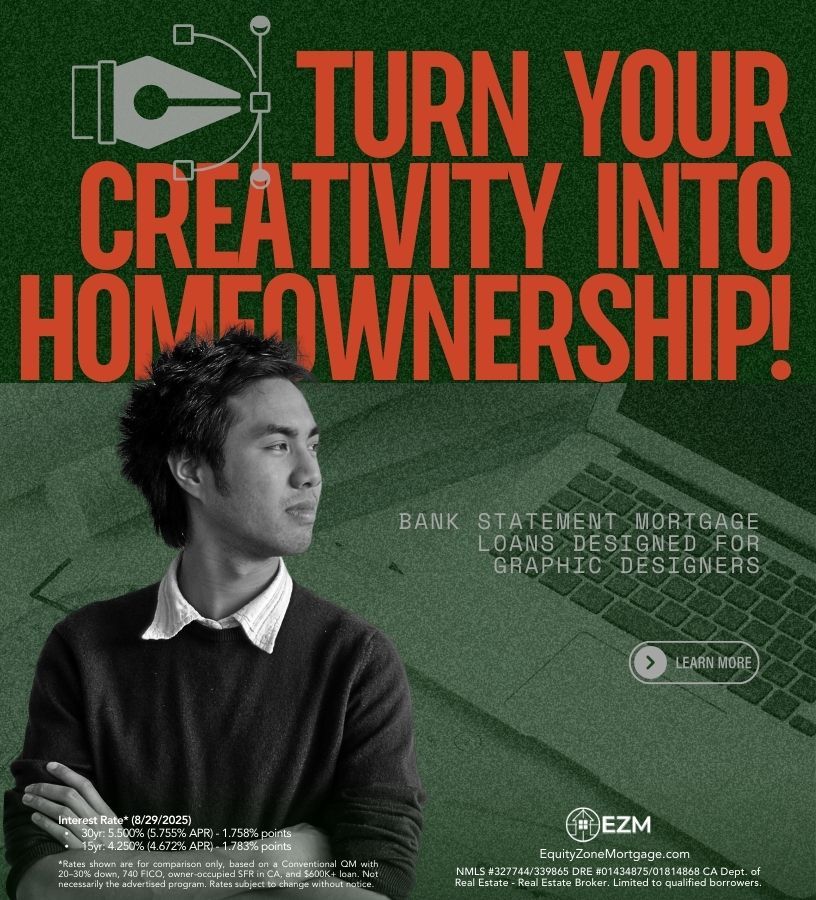

Turn Your Creativity Into Homeownership!

Bank Statement Mortgage Loans Designed for Graphic Designers

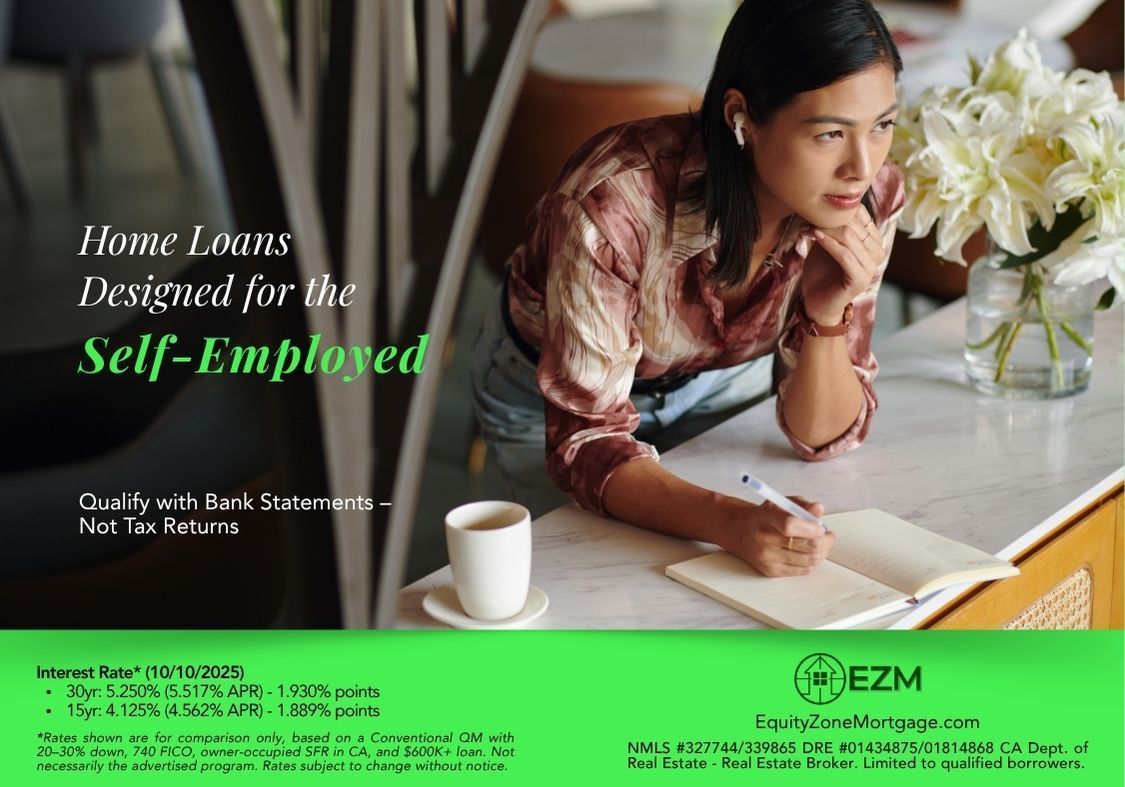

✅ No Tax Returns Needed – Qualify using your bank statements instead of traditional income documents.

✅ Flexible Loan Options – Tailored solutions to fit the unique income flow of creative professionals.

✅ Own Your Dream Home – Leverage your design business success to secure the keys to your future.

Ready to design your path to homeownership?

Contact us today to get started on your Bank Statement Mortgage Loan!

Learn More:

https://www.equityzonemortgage.com

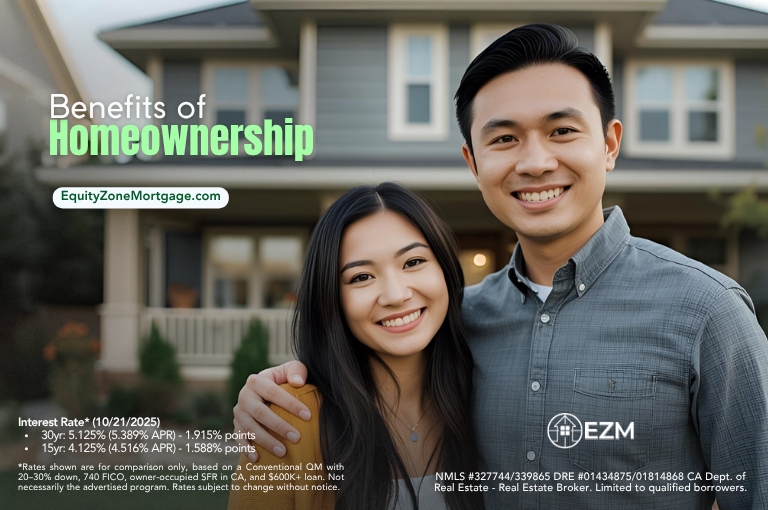

Maximize Your Home Buying Power!

READ MORE POSTS